You won’t have any shortcut to double your money overnight because there’s no magic in wealth creation. Wealth creation requires planning, patience, and early action. You will come to know about legitimate schemes to double your money.

Before we proceed you should first learn about the “Thumb Rule 72”.

What is Investment Thumb Rule of 72?

Rule 72 or Thumb Rule of 72 is a simple formula to know how much time your invested money will take to become double in the amount on the fixed rate of return.

The Formula is – Divide 72 with the Rate of Return on your Investment (ROI).

Let’s understand with the example below –

Assuming your investment in a Fixed Deposit at an interest rate of 6% p.a.

According to Rule 72,

the formula is “72/Interest rate”

= 72/6 = 12 years.

This means if you invest Rs. 1 lakh in FD today, it will take 12 years to become Rs. 2 lakhs.

How to Double Money in 5 Years

If you want to double your money in 5 years, then you can apply the thumb rule in a reverse way.

Divide the 72 by the number of years in which you want to double your money. So to double your money in 5 years you will have to invest money at the rate of 72/5 = 14.40% p.a. to achieve your target.

If you look for secure investment options, there is no option that offers 14.40% returns. You can expect that return from mutual funds & the stock market but those are not secure investment options.

If you are looking for an online side hustle to start with your job, there are many options to earn money online in India that include freelancing, content writing, and tutoring. You can start working from home to earn money without putting in any investment.

Top 10 Best Money Doubling Schemes in India 2023

#1. Tax-Free Bonds

Government issue Tax-Free Bonds to raise capital. Tax-Free bonds have a long-term maturity of 10 years to 20 years. You cannot liquidate the bonds before maturity.

You can expect a 5.50% to 6.50% rate of interest on Government Bonds. Bonds are a better deal than Fixed Deposits because your maturity corpus is tax-free as compared to a tax deduction on maturity amount in FDs.

You can double your money in 12-15 years based on the interest rates.

Tax-Free bonds are ideal for those people who come under tax bracket and want to invest for long term without putting money at risk (like stocks).

#2. Corporate Deposits/Non-Convertible Debentures (NCD)

Non-Convertible Debentures (NCDs) are good long-term investment options for those who want to invest in safe instruments but want better returns as well. NCDs (or Corporate Deposits) offer better interest rates than other schemes ranging between 5.50% to 9%. Their rate of interest depends on their CRISIL or ICRA ratings.

Big companies issue NCDs to accumulate long-term capital. Its a kind of taking a loan from the public and paying interest in return.

Image Source: ETMoney.Com

NCDs offer good returns, liquidity, and low risk.

You can double your money in approx. 8-10 years by investing in NCDs.

#3. National Savings Certificates

National Savings Certificates is a fixed income investment offered by the Postal Department of India. These are one of the safest investment avenues. NSCs come with a fixed interest rate and fixed tenure i.e. for 5 years and 10 years. You can also get tax benefits as no TDS is deducted on the maturity amount and you can also get tax rebate up to Rs.1.50 lakhs u/s 80C.

Along with that, you can also use NSCs as collateral security to get a loan from banks.

The current interest rate on NSCs is 6.8%. Your money will be doubled in 10.5 years.

You may also like to read – 11 ways to earn money online for students in India

#4. Kisan Vikas Patra (Post office scheme to double the money)

Kisan Vikas Patra (KVP) is a certification scheme in which invested money gets doubled in around 10 years based on the interest rate. KVP is a financial product of the Post Office.

Currently, KVP offers a 6.9% interest per annum.

KVP is a safe investment as it is not subjected to market risks. Double the investment is guaranteed once the tenure ends.

KVPs are more flexible than PPF or Bonds as you can withdraw from the KVP scheme after 2 ½ years. KVP can be transferred from one person to another person easily.

It can be used as collateral security in banks against loans. You can check the full details of post office double money scheme here

Kisan Vikas Patra (KVP) Interest rate – 6.9%

Post office interest rates table 2023

| Investment | Interest Rate |

| Post office savings account interest rate | 4% |

| National savings recurring deposit (5 years) | 5.8% |

| 1 year fixed deposit | 5.5% |

| 2 year fixed deposit | 5.5% |

| 3 year fixed deposit | 5.5% |

| 5 year fixed deposit | 6.7% |

| Kisan Vikas Patra | 6.9% |

#5. Public Provident Fund (PPF)

Public Provident Fund (PPF) is a long term and risk-free saving scheme by the government of India. This scheme offers a tax-exempted return on investment with an added interest of around 7.10% per annum.

You can double your amount in 10 years by investing in PPF.

You can open PPF account in the post office as well as in the banks. The PPF has a minimum tenure of 15 years, but you can extend the investment in blocks of 5 years each time.

You have to contribute at least once a year till maturity.

#6. Bank Fixed Deposits

Fixed deposits are the most widely used investment instrument in India. You can open FD in banks as well as Post Offices. You may get better interest rates in the post office as compared to banks.

FDs give you an annual return around 2.90% to 5.30% (0.5% to 1% higher for senior citizens). You can double your amount in more than 14 years.

You will have to pay tax on the maturity corpus if the interest accrued is more than Rs. 10,000. However, senior citizen can get tax exemption on the interest earned against Fixed deposits. The exemption is up to Rs. 50,000 of interest earned.

You can use the fixed deposits for regular or monthly income plans in which your savings account will be credited with the interest amount at the prescribed regular period.

#7. Mutual Funds

Mutual funds are the most convenient way of investing in the markets when you do not have the time and expertise. You can take a little risk but rewards are good.

If you invest in equity mutual funds, you can expect a return in the range of 14% to 18%. Some funds like L&T India Value, Mirae Asset India, and ICICI Prudential Blue Chip has delivered return in the past.

You can double your income in 4-5 years.

The investment in mutual funds can be a lump sum or monthly SIP for an amount as low as Rs. 500.

#8. Stock Market

Stock investment is the best option for persons looking for growth and building wealth. Investing in direct stocks carries higher risks but returns are high. You may lose as much as 50% of the capital.

On the other side, if we talk about returns on individual stocks are high (>20%) for fundamentally strong companies over a longer period.

For example, Eicher Motors generated a 5-year CAGR of 28.77%.

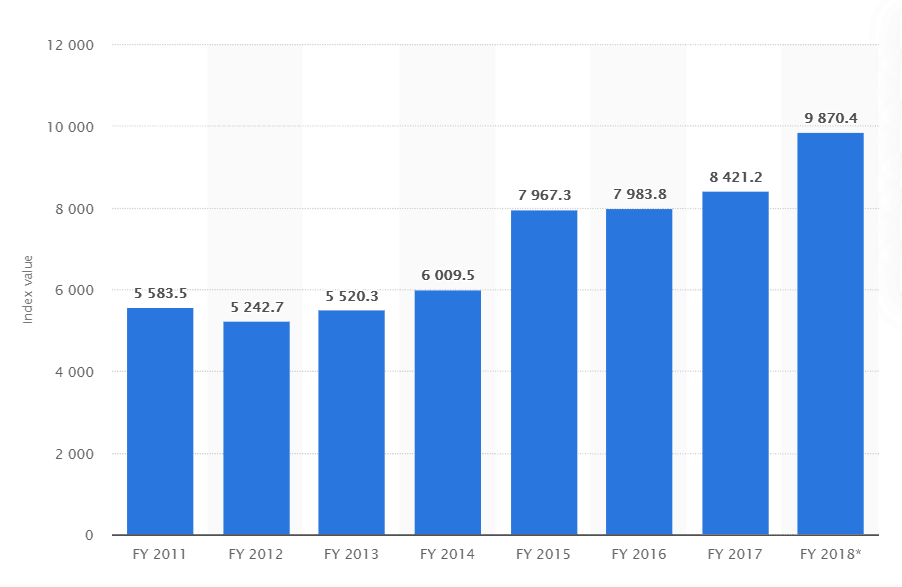

Image Source: Statista.Com

Currently, NSE has crossed 12000 mark. You can see NSE crossed double in the last 10 years. The last 1-year return of NSE is 12.40% and in the last 2 years generated a 26.5% return.

You can expect to double your money in 3.5 years, however, I would recommend investing for long-term (more than 5 years) in stocks.

You may like to read – 11 best ways to earn money from Instagram

#9. Gold/Gold ETFs

Love for the Gold is irresistible for Indian.

Gold has given consistent returns of around 10% in the previous years. A better way to invest in gold is to invest in Gold ETF and gold bonds.

You can also invest in Sovereign Gold Bond Scheme regulated by the government and RBI. You will own gold in the ‘certificate’ format. The value of the bonds is assessed in multiples of the gold gram. The initial minimum investment is 1 gram of gold.

You would earn 2.5% interest per annum on the amount invested. The Lock-in period is 8 years.

You can double your amount in 8 years approx.

#10. Real Estate

The investment in residential real estate generates regular rental income and appreciation. You can get the benefit of owning an asset, have diversification and even save on taxes (tax exemption on home loan).

You can expect an annual return of 11%. The amount of property can be doubled in 6-7 years.

Real Estate investment requires huge capital to invest and return depends on multiple factors like location and other infrastructure developments in nearby regions.

I have covered the reviews of top credit cards in India. If you love to save money using credit cards you can look for these articles

- Axis Vistara Infinite credit card review for up to 6 free business class air tickets on milestone

- Citibank IndianOil credit card review to save up to 5% on your fuel spends

- BPCL SBI credit card review to get up to 6.25% reward value on BPCL fuel and gas

- SBI Pulse credit card review to save up to 2.5% on your pharmacy & chemist expenses.

- IDFC First Classic credit card review is best in the category of lifetime free credit card

Conclusion

Now you have come to know about 10 legitimate schemes to double your money in India. Let me know about your thoughts in the comments.

Nice article. In mutual funds, one can invest in sector funds like Pharma funds where one can double their money in just 3-5 years. Yes these are high risk investments.

Mr Jain ,

I want to invest lump sum amount of Rs. 3 lacs in share market for 10 years. Pls suggest the best way to maximise the return.

Swati

If you are interested in a company investment to get money doubled up in 5.5 years, let me know

Regards

Latha

I am an employee,with average income.But i have saved around 50k which i can invest for a period of 6 months.Please suggest the best way of getting max returns on this small saving.

At last i will have to go for term deposit

Thank you

Punjan

You can double up in 5.5 years

If you are interested, let me know

Regards

Latha

i am a 2500000 in inwestment

Very good advise and tips on how to double your money. There is risk in every thing we invest.

My advise to those people who are claiming that you have savings money and would like to invest, don’t blindly believe in a person who claims that they will double your money or triple your money very fast. Do your own home work, ask what kind of investment schemes they have, understand the risk associated with them before you commit your savings.

The article first looked like a click bait about some Ponzi scheme. Money doubling schemes in India are notorious for fooling people. But the author explains how you can invest in reliable schemes for long term and double your money. The rule of 72 is the best thumb rule to use.

The better way to invest is on education sectors, there your money will be increasing and also it will be safe.

Khan!

If you are still interested in investment, please mail me to share the details

Can be doubled up in 5.5 Years

Regards,

Latha

Invest in Gods work Lord Jesus Say, Love your Neighbor and enemy like your body . i surely give you guaranty your money will be 100 time dabble .

May God bless you.

Start with SIP and a small amount of lumpsum Mutual fund and then you can move to Portfolio management services.

hello where i can start SIP

if i invest 2 lacks rupees in 2.5 years how much i get after 3 years

if i invest 2lacks in 2.5 years how much i will get after 3 years.

i want to study for MBA , after 3 years .

i am doing BA 1year and also doing job in a company .

i am 18.3 years old .

so please suggest me about this.

I want to double. My money in 5 to 6 years term. Please suggest the safest plan my cell no 9075179394 please call

i am for help you

Pleas help me

Please.suggestions plan and the bank where o can invest

namaste, any body interested to invest in films pls do contact me.. .

start a street food bussiness…..

Dear All,

I am retired.

My investment limit is upto one lac.

I need 30k per month.

What is the best way to invest ? Where and When ?

Pl. reply.

want to open a trading account..,,

which company is cheapest and best

Trade plus online

I hav two lakhs …i want to invest for two years ..i am from Andhra.. i want to get more double mony to go to abroad for studies..aftr two yrs how much i get..Is there any best investment…

In bad market days invest in equities n mutual funds. In staggered manner when market stabilises ..do more investment s. Equity related mutual funds gave me good returns in past. Equity holding is giving me steady earning too!

Which euity funds you mostly earns dir

Sir can you brief about this bike taxi business .

Sir can you tell me in detail plz

Sir,I am govt Retd employee. I want to invest Rs 15 lakh of my retirement fund.I can’t take risk.Which is the best scheme of P.O. or bank ? Please also tell ..are NSC’S better for me? Interest is taxable or not?

Sire invest in Senior Citizen Savings Scheme (SCSS) in any Post office and you get 8.6 interest rates and the max you can park is 15 Lakh. So will be safe and best return of investment.

go for nsc

Invest Five lakhs in kisan vikas patra which will double after 10 years. Invest other five lakhs in FD for 5 years. And do systematic widhrawl of 5 lakhs. You will never lose your money. Thank me later ☺️

Sir pls invest in insurance backed schemes with good rate of returns .. No tax for wealth corpus

Dear All,

The best way to Invest money and get good profits is Healthcare Industry. We are seeing many new infections such as swine flu, bird flu, meningitis, ICU related infections and other respiratory diseases due to increasing water, air and meat pollution in our country. Govt. Is estimating that infection diagnostics market will grow to several billion dollars within next 3 to 5 years. This is the reason, we did our PhD in Molecular diagnostics and research in healthcare and setup our own diagnostic lab in Bangalore. All corporate hospitals are sending us patient samples every day for above infections and we provide them accurate results within 24 hours time. We are open to provide shares in our company against your investment. We are now 3 years old and our growth has been 100% compared to last year. If you feel really believe about healthcare investment will boom, kindly contact me. Thanks. Dr. ARJUN

My contact is nine six three two zero nine five four eight eight

Hi! What are the terms and conditions and anything exclusive for doctors

Good day Dr. Arjun

I take interest in your proposal to invest in you medical diagnostic company.

Could you provide me with more information.

Buy land.. and make rental building…

Let in 1 Kota land you make 5-10 floor building and in each floor 2 rental house…and monthly rent of each house would be 10000…

If your total investment is 1 cr then it will take 100 months to cover your investment..

I.e. 10000(monthly rent) x 10 ( rent house) x 100 (month)= 1 cr

100 months = 8.4 yrs