A salary slip is a monthly financial document issued by the employer to an employee. A payslip records the details of an employee’s salary components like Basic salary, HRA, Bonuses paid, and deductions for a specific pay period.

Bounded by law, salary slips must be issued to employees periodically as proof of salary payments and deductions made.

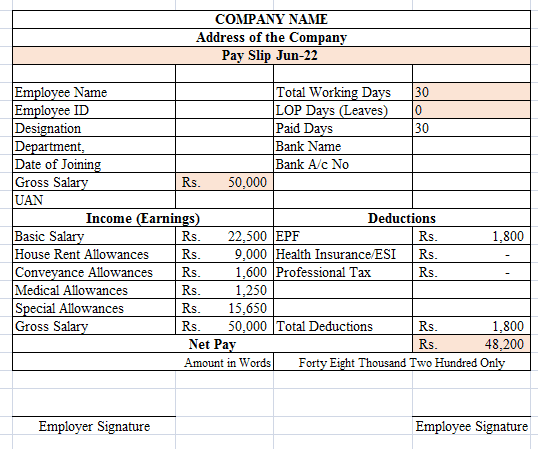

Salary Slip Format

Salary slip contains mainly two components –

- Income

- Deductions

Before discussing the above said major components of a Salary slip, let’s have a look at what a salary slip looks like –

Also read – How to earn money online for students in India

Income Components of Salary Slip

#1. Basic Salary

Employees’ basic salary is a fixed amount of monthly salary. Usually, it is fixed at 35-40% of the total salary. It is the starting point of any calculation of gross pay.

#2. Dearness Allowance

Dearness allowance (DA) is a component of salary that is paid to employees to offset the impact of inflation. It is a fixed percentage (usually 30-40%) of the employee’s basic salary and is paid in addition to the regular salary.

Dearness allowance is a cost-of-living adjustment paid by the government to government employees and pensioners. The amount of dearness allowance payable is determined by the government, based on the consumer price index (CPI).

Note – DA is mandatory for government employees but optional for private employers. So private companies may or may not pay DA to their employees.

#3. House Rent Allowance (HRA)

House Rent Allowance (HRA) is a reimbursement for the rent that the employee pays for the accommodation. The amount of HRA depends on the city or town where the employee lives and their salary.

HRA is exempt from income tax under Section 10(13A) or section 80G in the Income Tax Act, 1961. To claim HRA exemption, individuals must provide rent receipts and the rent agreement to their employer.

HRA exemption

- Rent paid – 10% of the basic pay (basic + DA)

- 50% of basic pay (basic + DA) for a metro city employee or 40% of basic pay (basic + DA) for non-metro city

- Total HRA received; whichever is lower of the three.

If you have credit cards that provide more than 2% reward value then you can check out the best platforms that allow you to pay rent with credit cards.

#4. Conveyance Allowance

Conveyance allowance, also known as transportation allowance, is paid to an employee to reimburse the cost of commuting between home and work. The purpose of the conveyance allowance is to help employees cover the cost of travelling to and from work.

In some cases, the employer may also provide transportation for the employee between their home and work location.

Conveyance allowance exemption under section 10 sub-section 14(ii) of the Income Tax Act and Rule 2BB of Income Tax Rules.

- Rs. 1,600 per month or 19,200 per year

- Amount paid above the conveyance allowance limit is taxable.

#5. Medical Allowance

Medical allowance to cover the cost of medical expenses during the employment period. The employee only gets the claim on the submission of medical bills as proof.

Medical allowance can also be used to cover the costs of employees’ health insurance premiums. The exemption limit for medical allowance is 15,000, the amount exceeds becomes taxable.

#6. Leave Travel Allowance (LTA)

Leave travel allowance is given by employers to cover the cost of employee travel along with immediate family members while on leave.

#7. Bonus and other Special Allowance

Bonus and other special allowances is depending upon the performance of an employee or any other prefixed parameters. The purpose of the bonus is only to encourage employees to meet their certain goals or exceed expectations. Special allowances are taxable.

There are many ways to earn money online in India. You can pick one thing to start a side hustle along with a job.

Deduction Components of Salary Slip

#1. Professional Tax (PT)

Professional tax (PT) is levied on individuals who are engaged in certain professions or work in specific industries. The tax is imposed by the state government and is used to fund various social welfare schemes.

Professional tax is applicable in a few states in India – Punjab, Karnataka, West Bengal, Uttar Pradesh, Andhra Pradesh, Telangana, Maharashtra, Tamilnadu, Gujarat, Assam, Chhattisgarh, Kerala, Meghalaya, Orissa, Tripura, Jharkhand, Bihar, Sikkim, Mizoram, and Madhya Pradesh. The amount of professional tax in different states has different rates.

#2. Tax Deducted at Source (TDS)

Tax is deducted at source (TDS) from the employee’s salary and is paid to the income tax department by the employer. The amount of TDS is based on the income tax slab provided.

I. As per the old tax regime

| Income Tax Slab | Tax Rate |

| Up to Rs 2.5 lakh | NIL |

| Rs. 2.5 lakh – Rs. 5 lakh | 5% |

| Rs 5.00 lakh – Rs 10 lakh | 20% |

| > Rs 10.00 lakh | 30% |

II. As per New Regime Income Tax Slab Rates FY 2021-22

| Income Tax Slab | Tax Rate |

| Rs 0.0 – Rs 2.5 lakh | NIL |

| Rs 2.5 lakh – Rs 3.00 lakh | 5% (tax rebate u/s 87a is applicable) |

| Rs 3.00 lakh – Rs 5.00 lakh | |

| Rs 5.00 lakh- Rs 7.5 lakh | 10% |

| Rs 7.5 lakh – Rs 10.00 lakh | 15% |

| Rs 10.00 lakhs – Rs 12.50 lakh | 20% |

| Rs 12.5 lakhs – Rs 15.00 lakh | 25% |

| > Rs 15 lakh | 30% |

TDS is calculated after deducting all estimated deductions under various sections like 80C from the annual income and then dividing by 12 to add to the monthly salary slip.

If your estimated annual income after deductions is below Rs, 2,50,000, then your employer won’t deduct the TDS.

You can also file a TDS refund claim if the employer has deducted more tax than the actual liability while filing your income tax return and claiming the difference.

#3. Employee Provident Fund (EPF)

Employee Provident Fund (EPF) is a retirement savings plan in India. All salaried employees must contribute 12% of their salary towards EPF. The employer also contributes an equal amount.

- Employee contribution = 12% of (Basic + Dearness allowance)

- Employer’s contribution = 8.33% towards EPF + 3.67% towards PF

The contributions are deposited in a provident fund account and the employee can withdraw the money after retirement and remains unemployed for more than 2 months.

#4. Labour Welfare Fund (LWF)

Labour Welfare Fund (LWF) is meant for the welfare of the labourers basically. LWF is the amount deducted from the employee’s salary every month and the fund is managed by the labour department of the state government.

The purpose of LWF is to provide social security and improve working conditions, medical care, and education facilities to workers and their dependents.

LWF varies from state to state throughout the country. For example, in Maharashtra LWF is applicable except for those working in managerial or supervisory positions drawing monthly wages above Rs. 3500.

Labour Welfare Fund Act is applicable in the states of Andhra Pradesh, Chandigarh, Chhattisgarh, Delhi, Goa, Gujarat, Haryana, Karnataka, Kerala, Madhya Pradesh, Maharashtra, Odisha, Punjab, Tamil Nadu, Telangana & West Bengal.

Note – LWF is basically applicable for labourers and is only included in the salary slip if your job profile comes under labour work.

You may also like to read – how to earn money from home without investment

How To Calculate CTC From Salary Slip

Cost to Company (CTC) is the total amount that the company spends on the employee. This includes the

- Employee’s salary

- Allowances

- Bonuses

- EPF and other benefits.

CTC can help you understand how much your employer is spending on you and what your total compensation package includes.

CTC = Gross Salary + Deductions or Benefits (Direct Benefits + Indirect Benefits + Savings Contributions)

OR

CTC = Earnings + Deductions

Here, Earnings = Basic Salary + Dearness Allowance (optional) + House Rent Allowance + Conveyance Allowance + Medical Allowance + Special Allowance.

Deductions = Professional Tax + Tax Deducted at Source + EPF Contribution

Gross salary is the total amount of money that an employee earns before any deductions are made.

Net salary is the amount of money that an employee takes home after all deductions have been made.

CTC Calculation from Salary Slip

Let’s take the above-mentioned salary slip format example to explain the CTC calculation.

Earnings

If an employee’s Basic Salary (annual) – Rs. 3,00,000 (50% of gross salary)

- HRA – Rs. 1,20,000 (40% of (basic salary)

- CA – Rs. 19,200 (Rs. 1600 per month)

- Medical Allowance – Rs. 15,000 (Rs. 1250 per month)

- Special Allowance – Rs. 1,45,800 (based on performance)

Total Earnings/ Gross Salary = 3,00,000 + 1,20,000 + 19,200 + 15,000 + 1,45,800 = 6,00,000 or Rs. 50,000 per month.

Deductions

EPF Contribution – Rs. 21,600 (12% of (basic salary = Rs. 1800 per month)

Total Deduction = Rs. 21,600

Therefore, CTC = Earnings + Deductions

= 6,00,000 +21600 = 6,21,600

CTC is Rs. 6,21,600

Frequently Asked Questions

#1. What is YTD in salary slip

YTD or Year to Date is used to calculate how much money you have earned up to the present date.

#2. What is DA in salary slip

DA or Dearness Allowance is a fixed percentage of the basic salary paid to employees to compensate for the rise in prices of goods and services.

#3. What is professional tax (PT) in salary slip

Professional tax (PT) is levied by the state government which is deducted from employees’ salaries and professionals every month.

#4. What is HRA in salary slip

House Rent Allowance (HRA) is a tax-free allowance up to a specific limit that an employee can receive from an employer to help cover the cost of the rent.

#5. What is LWF in salary slip

The Labour Welfare Fund (LWF) is a statutory fund maintained by the Indian government. The fund is used to provide social security and welfare benefits to workers in the organized sector in India.

#6. What is LTA in salary slip

LTA or Leave Travel Allowance is a monetary allowance given to employees by their employers to cover the costs of travelling for employees and their immediate family members.

If you do frequent air travel then you can check the list of best debit cards for free airport lounge access to enjoy the complimentary food, Wi-Fi and stay.

#7. What is ESI in salary slip

Employee State Insurance (ESI) is a social security scheme run by the Indian government. The program is funded by contributions from both employers and employees. The scheme provides socio-economic benefits like sickness, maternity, unemployment, and death expenses to workers and their immediate family members and dependents.

- Employer’s Contribution – 3.25% of gross salary.

- Employee Contribution – 0.75% of the gross salary.

#8. What is LOP in salary slip

Loss of Pay (LOP) means leave without pay (LWP). LOP is the amount deducted from the employee’s monthly salary when employees take leave which is not authorised/available.

LOP leave applies when an employee consumes all his casual leaves, sick leaves, and earned leaves and does not have a leave balance in his/her account.

Check out – how to earn money from Instagram

Conclusion

A salary slip comes in handy in various things like planning the income tax return, proof of your last withdrawn income that you can further use in banks for loans, getting credit cards, opening a demat account or switching your job.

If you want to apply for a credit card, I would recommend reading my review for the Axis Ace credit card, HDFC Moneyback credit card and HDFC Millennia credit card. All these credit cards are beginner-level cards with decent benefits.

Since you have understood the importance of a pay slip, you should always save its copies for future requirements.