You cannot pay rent directly through your credit cards. However, there are several rent-paying apps available in India that allow you to pay your rent through your credit card.

These apps charge a convenience fee for using their service, which can vary from platform to platform. It is important to check the processing fee and other charges before choosing a platform to pay rent with a credit card.

Additionally, it is recommended to make payments on time and avoid carrying balances on your credit card to avoid high interest charges and potential debt traps.

Choosing the Right Platform to Pay Rent with a Credit Card

When choosing a platform to pay rent with a credit card, there are several factors to consider, such as fees, rewards, security, and ease of use. Here are some tips and guidelines for selecting the best platform for your needs:

- Check the processing fee: Make sure to check the processing fee charged by the platform, as this can vary from platform to platform. Some platforms may charge a higher fee for certain credit cards, so make sure to read the fine print.

- Look for rewards and benefits: Many platforms offer rewards and benefits for paying rent with a credit card, such as cashback, discounts, and reward points. Make sure to check what rewards are available and whether they are worth the processing fee.

- Check the security features: Make sure the platform you choose has robust security features to protect your personal and financial information. Look for platforms that use encryption, two-factor authentication, and other security measures to keep your data safe.

- Ease of use: Choose a platform that is user-friendly and easy to navigate. Make sure the platform offers multiple payment options, such as UPI, net banking, and debit card payments, in addition to credit card payments.

- Customer support: Check whether the platform offers reliable customer support in case you face any issues or have any queries. Look for platforms that offer multiple channels of support, such as phone, email, and chat support, to ensure that you can get help when you need it.

By considering these factors, you can choose the right platform to pay your rent with a credit card that meets your needs and preferences.

To make it easier for you, we have compiled a list of the six best platforms to pay rent with a credit card in India.

Quick Comparison of Rent Payment Platforms

| Rent Payment Platform | Processing Fees | Supported Credit Card |

| Magicbricks | 0% on partner cards and 1.5% on others | Mastercard, Visa, HDFC, Razorpay |

| Redgiraffe | 0.39% | All credit cards |

| Cred | 1 to 1.5% | Mastercard, Visa, RuPay |

| Paytm | 1 to 1.5% | Mastercard, Visa |

| Housing.com | 1.5% | Mastercard, Visa |

| NoBroker.com | 1% | Visa, Mastercard, HDFC, Amex |

6 Best Platforms to Pay Rent with Credit Card in India

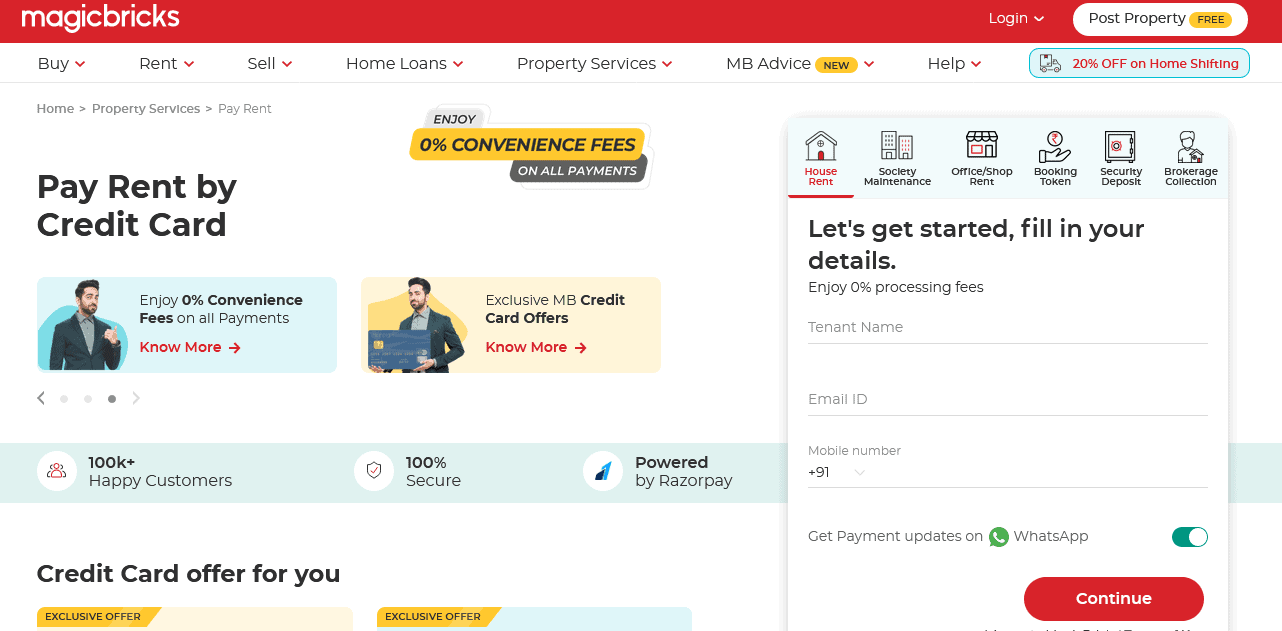

#1. Magic Bricks

Magic Bricks, one of the leading property platforms in India, also provides a platform for tenants to pay rent with a credit card. You can make rent payments through your credit cards with no processing fee if the card is a partner card.

For VISA or a Mastercard credit card, the processing fee is only 1.5%. Magic Bricks also offers a variety of rewards and benefits, including cashback and discount coupons for various services.

Once you initiate the payment, your landlord receives it within 24 hours, and you will receive an immediate rent receipt via your registered phone number or email ID. The registration process is fairly straightforward, and you will need to provide a rental agreement.

By paying your rent through Magicbricks using a credit card, you can enjoy a range of benefits such as:

- You will get a 100% discount on processing fee upto Rs.50.

- Credit Cards of HDFC, IDFC First and AU Small Finance banks are eligible for a “0% Convenience Fees.

- Offer Period 1st – 31st march 2023

- Subject to a single minimum rent payment of INR 8,333/- in a month.

- You need to upload a rent agreement to avail the offer.

- Not Valid for UPI payments.

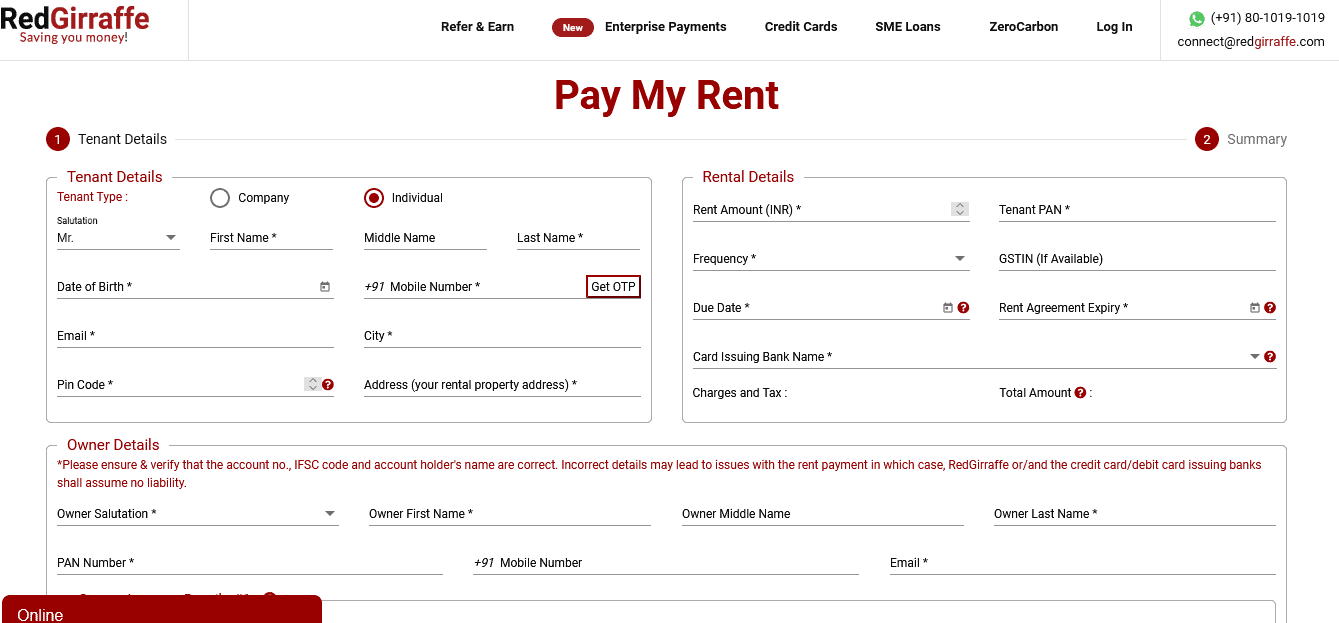

#2. RedGirraffe

RedGiraffe is a popular platform that offers a smooth, hassle-free experience to pay rent with a credit card. It charges a processing fee of 0.39% +GST for every Rs 10,000, which is lower than some other platforms. If your rent is above Rs. 20,000, you will need to upload your Rent Agreement.

However, the only major downside with RedGirraffe is the detailed registration process. You need to provide the completed details of including PAN card information for tenants and owners. Once verified, RedGirraffe issues a biller registration ID in approximately 2-3 days, ensuring a secure and hassle-free payment experience for all parties involved.

Rentpay benefits with RedGirraffe –

- You can earn 5% as cashpoints with a maximum cap of 3000 RedGirraffe CASH Points each month. (1 Cashpoints = Rs. 1)

- RedGirraffe CASH Points can be redeemed over 300+ merchant brands including gift cards & brand vouchers.

- 0% Cost on converting Annual Insurance Premium to EMI.

- You can avail 45-56 days FREE Credit Period.

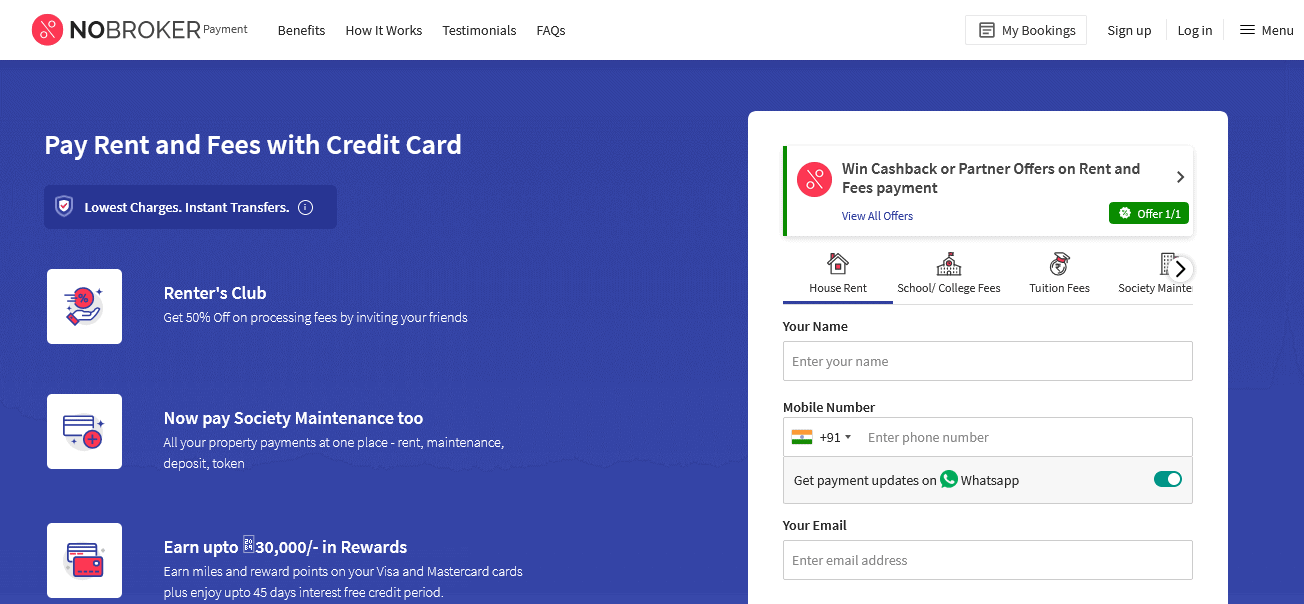

#3. NoBroker.com

NoBroker.com is a real estate application that offers a wide range of services such as buying, selling, and renting properties. One of its unique features is the ability to pay your society maintenance and rent through the app using your Mastercard or Visa credit cards.

By choosing to make rental payments through the app, you can earn exclusive rewards and enjoy an interest-free credit period. The user-friendly interface of the app makes it easy to complete the payment process, and you will receive rent payment alerts every month on the set date. The app charges a convenience fee of 1% for paying your rent.

Benefits of paying the rent using a credit card via NoBroker are –

- You can earn up to 50% off on processing fees by simply referring your friends to use the app.

- You can earn reward points of up to Rs. 30,000 on your Visa or Mastercard, and even earn points on your yearly spending.

- This 30,000/- is calculated assuming an annual rent of 4.5 Lakhs on a Club Vistara SBI Card PRIME (Premium).

- Earn miles and reward points on your Visa and Mastercard cards plus enjoy upto 45 days interest free credit period.

- You can make the property payments at one place – rent, maintenance, deposit, and token.

- You’ll receive your payment receipt instantly on your registered email address.

- Your landlord can expect to receive the rent payment within just 2 working days of initiating it using the credit card.

#4. CRED

Cred is a highly popular credit card bill payment application. You get rewards for making timely payments on your credit card bills. In addition to facilitating easy payment of credit card bills,

Cred allows you to pay your rent and earn cashback and other rewards. While making rent payments, you may be charged a processing fee of 1-1.5% depending on the credit card network you use.

Benefits of paying rent through credit card on CRED

- You also receive timely rent payment alerts every month on the set date, ensuring that you never miss a payment deadline.

- You can make rent payments online instantly without any delay.

- You get to enjoy an interest-free credit period by paying rent through credit card.

- CRED members earn exclusive reward points on rent payment.

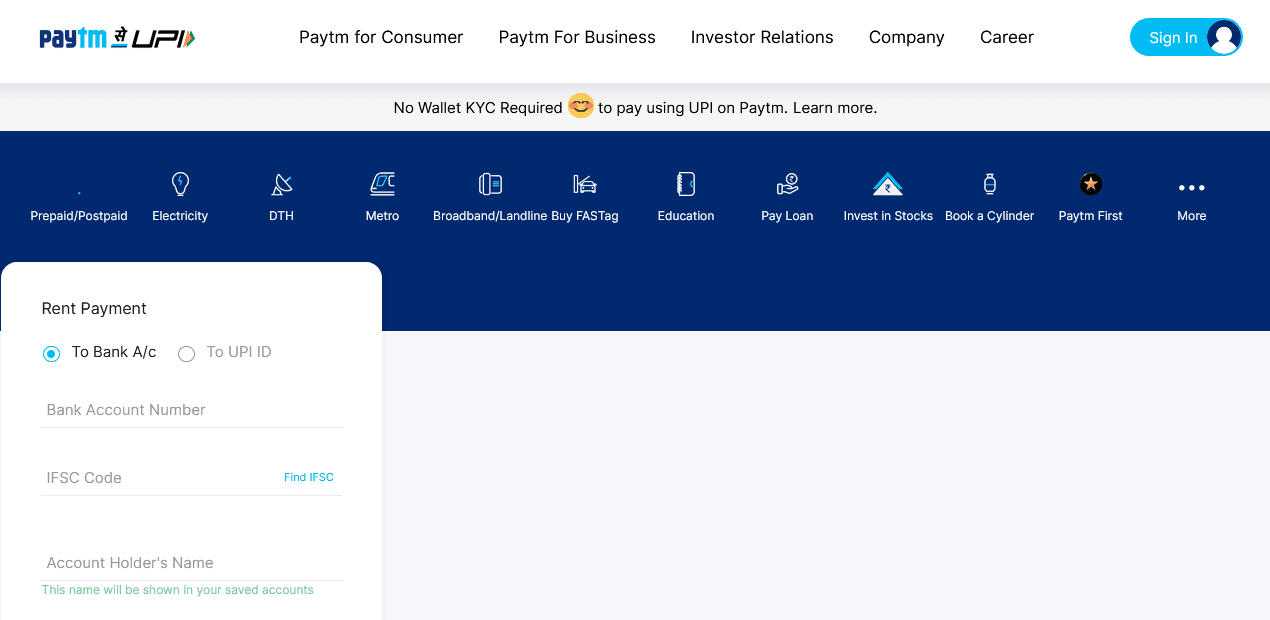

#5. Paytm App

Paytm, one of India’s largest digital payment platforms, also provides an option to pay rent with a credit card. You can also choose to transfer funds to your landlord’s UPI ID or bank account. No prior registration and rental agreement are required.

With a processing fee of 1% plus GST, Paytm makes it easy for users to pay your monthly rent using your credit cards. The platform also offers a range of other services, including mobile recharge, utility bill payments, and more.

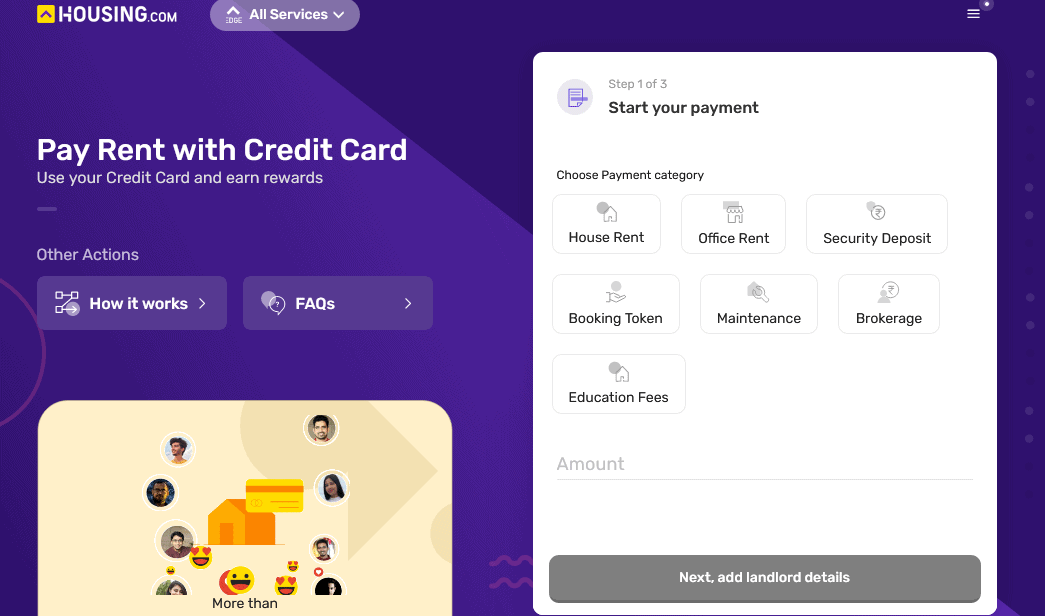

#6. Housing.com

Housing.com is a popular online real estate platform in India that also provides an option to pay rent with a credit card. With a processing fee of 1.5%, Housing.com allows you to pay your monthly rent using your Mastercard, Visa credit cards. The platform also offers a range of other services, including house rentals, property management, and more.

To make rent payments through the platform, you will need to download the Housing app and make a minimum payment of Rs. 3000. The sign-up process is hassle-free and doesn’t require any documents, and the rent payment is typically settled within an hour.

Paying rent through Housing.com with a credit card offers several benefits, including:

- You can earn reward points from your credit card provider but how much reward points is not disclosed.

- Ensuring 100% safe and secure transactions with your credit card.

- Enjoy a 45+ days interest free period.

- Receiving instant digital rent receipts on your registered email address.

Credit Card For Rent Payment

Paying rent through certain platforms may involve a processing fee of 1-2%. However, if you hold a credit card that offers a reward redemption return of 2% or more, you can use it to pay your rent and get still receive the remaining reward benefit. Additionally, you can enjoy up to 45 days of interest-free credit card bill payment.

These are the credit cards which give you 2% more reward redemption return. Detail as below –

- Axis Ace Credit Card provides you overall 2% return on all your online & offline spends.

- Sc Ultimate credit card offers you 3 RP per Rs. 150 spent which is 2% reward return.

- HDFC Infinia Credit Card offers a reward redemption rate of 3.3% on your spends.

Advantage/Disadvantage of Paying Rent with a Credit Card

Advantages of Paying Rent with a Credit Card

Paying rent with a credit card can offer several benefits to Indian consumers. Here are some of the advantages of using a credit card to pay rent:

#1. Earn rewards points or cashback

Many credit cards offer rewards programs that allow you to earn points or cashback on your purchases. By paying rent with a credit card, you can earn rewards points or cashback on your payments, which can be redeemed for discounts, gift cards, or even cash.

#2. Build credit history

Paying rent with a credit card can also help you build a credit history. Consistently making on-time payments can improve your credit score over time, which can be beneficial when applying for loans or credit cards in the future.

#3. Improved cash flow management

Paying rent with a credit card can also help you manage your cash flow more effectively. By using a credit card, you can delay the actual payment of rent until your credit card statement is due, which can provide a buffer for unexpected expenses or emergencies.

#4. Interest-free credit period

Using a credit card to pay rent can also provide you with an interest-free credit period, depending on the credit card’s billing cycle. This can provide temporary relief to your cash flow, allowing them to manage your finances more effectively.

Drawbacks of Paying Rent with a Credit Card

#1. Credit Utilization Ratio

Paying rent with a credit card can increase your credit utilization ratio, which can negatively impact your credit score if it exceeds 30%. This can make it harder to obtain loans or credit cards in the future.

#2. Processing Fees

Most banks and credit card companies charge processing fees for paying rent with a credit card, which can range from 1% to 5%. If you have high rent payments, the processing fees can also be significant. Third-party apps used to make payments may also charge convenience fees.

#3. High Interest Rates

Credit cards typically charge high interest rates on outstanding balances. If you are unable to pay your balance on time, you may end up accruing significant interest charges and falling into debt.

#4. Payment Issues

Paying rent with a credit card may not always be successful due to issues such as exceeding your card limit or an expired card. In such cases, you may miss payments and have to resort to other payment methods.

Conclusion

You may go with Magicbricks as they offer 0% processing fee upto Rs.50.

RedGirraffe is the best option for rent payment with credit cards where you can earn 5% as cashpoints with a maximum cap of 3000 RedGirraffe CASH Points each month. (1 Cashpoints = Rs. 1). You can redeem these CASH Points at 300+ merchant brands including gift cards & brand vouchers.

If you have Club Vistara SBI Card PRIME (Premium), consider NoBroker.com is an ideal for making rent payment. You can earn reward points of up to Rs. 30,000 on an annual rent of 4.5 Lakhs.